Control Company Costs

Setting Post-Pandemic County Budgets and Sticking to Them

Stewarding a county budget has always meant working under pressure with complete transparency. But now, when most of your coworkers and partners are working remotely, cost control pressures and the demand for new ways to demonstrate spend transparency are greater than ever.

According to McKinsey & Company, many finance leaders are turning to zero-based budgeting, where anticipated expenses have to be justified and approved for each new budget period, in order to navigate through the great unknown of 2021. Even those who are sticking with the more traditional approach are producing budgets that match resources with strategy – knowing those strategies will most likely shift in the months to come.

“Organizations are putting new frameworks in place to prevent what they just went through from ever happening again,” shared Marchelle Klippenstein, vice president of customer improvement for SAP Concur. “Not that anyone can prevent a pandemic. But they can prevent the angst, emotional challenge, and tactical issues they faced in what will be their new environment.” The result is a more proactive, comprehensive approach to budget compliance. Instead of focusing in on one area or process, organizations are using data to understand how they operate today, and how to gain the visibility and control to ensure expenditures are not only valid, but directly support your county’s objectives.

All about the (expense) details

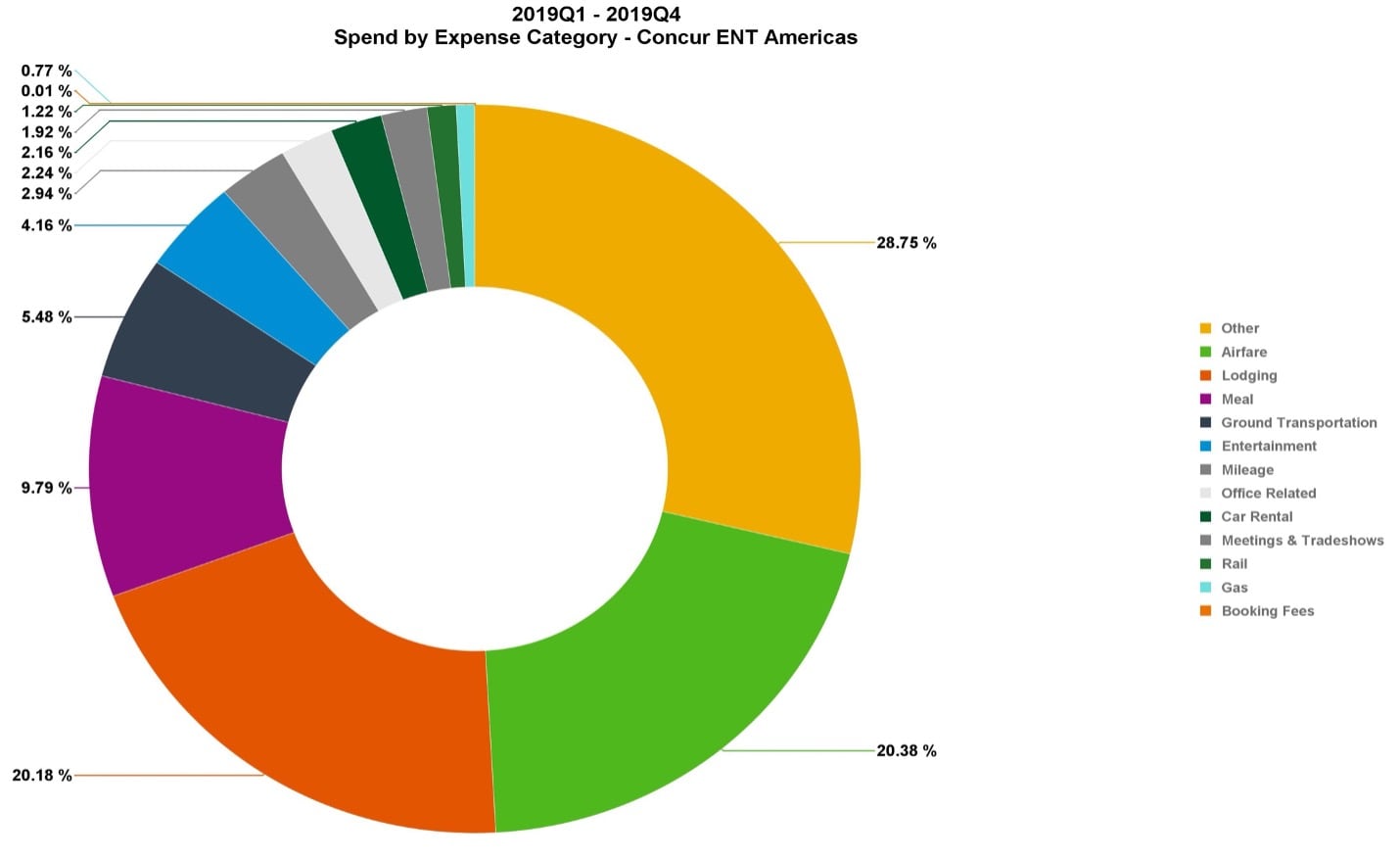

It’s impossible to manage what you can’t define or see – something organizations discovered all too quickly when the pandemic began. “Budgets are often maintained at departmental levels and have so many things rolled up in them, including travel and expense, that it becomes impossible to understand where the overages are coming from,” explained Jameson Hughes, client sales executive for SAP Concur. “For effective oversight, budgets have to be delineated down to the appropriate level.” When building your county’s budget categories, are you providing line-item details so that invoices and expenses can be properly reported and tracked? If not, it’s likely that costs are getting classified into the “other” or “miscellaneous” categories. Not only does this lack of budget detail categorization create more work for Accounts Payable teams to verify these expenses, but it also leaves room for error and fraud. If most of your expense details fall into the other/miscellaneous category, you’re not alone. We benchmarked our own clients’ spend by expense category from Q1 2019 through Q4 2019. At the time, more than 28% of those expenditures fell into the “other” category, and office-related expenses made up only a small percentage of the overall budget. While this delineation made sense pre-pandemic, in 2021 and beyond, counties should consider dissecting the “other” category further, adding expense categories that are reflective of what’s happening with their spend today.

Policy updates for the win

Even after a vaccine has eradicated the threat and life returns to some semblance of “normal,” it’s clear that the post-pandemic county work environment won’t look the same as it did before COVID-19 took its toll. According to a recent Brookings report, “consumer spending during the pandemic was unusual. Much of the decline affected services, such as hairdressing, which are less likely to be taxed than goods. There were large increases in purchases of food at the grocery store, which is typically not subject to the sales tax, and large declines in spending at restaurants and hotels, which are often taxed more heavily than other things. In aggregate, sales taxes look to decline $49 billion this year, $45 billion next year, and $46 billion in 2022, in part reflecting lower price levels and in part because of changes in demand.” While it’s crucial to set a policy around home office and personal technology spend, particularly if these weren’t detailed before, it’s also important to look at your historic spend data and identify areas where a small policy change could make a big difference. “[Organizations] are restructuring everything—their offices, their employee requirements and the tools available to their staff,” Klippenstein said. “At the same time, everyone is trying to figure out what the new version of employee mobility will look like. Everything is changing.” Ongoing evaluation as to how to adjust your financial policies will help you stay within your budgets as well as adjust for unplanned expenses. Change is inevitable and adjusting invoice and expense policies will help counties steward resources in agile, accommodating, and transparent ways.

Data-informed decision-making

You’ve got your county’s data—now it’s important to encourage everyone to use it to forecast and approve spend before it happens. In today’s climate, AP and finance cannot be the only overseer of spend and budget. Stakeholders and department heads must take an active part in that process, in a way that goes well beyond approving invoices and reimbursement requests. A siloed approach, with multiple systems operating in a vacuum, or reconciling spend against budget after the fact, just can’t deliver the sound financial governance counties need to navigate the years ahead. As organizations regroup, reposition, and adapt to a changed landscape, effective budget management is more critical than ever. Solving one issue here or adding another piece of software there simply can’t deliver the insight and agility that counties need. Organizations that take a holistic approach to cost control and budget management, and fully utilize their data to drive the desired outcomes are the ones that will be well positioned to succeed – no matter what surprises the future holds.

Since the COVID-19 pandemic, most organizations are taking the conservative approach to manage their budget: spending less, trimming more, and allocating the available dollars far differently than they did in years past. There’s also an amplified focus on fiscal governance; every dollar spent must produce an outcome. Download our whitepaper to explore how to use the power of your county’s spend data to improve budget compliance or spend against budget for a more holistic approach to budget management.

To learn more about how to optimize county financial operations, visit the SAP Concur partner page at the National Association of Counties.