Automated invoice processing

Your supplier invoice management process can be faster, simpler, and safer with automation.

Simplify your invoice processes and improve visibility by automating manual tasks

Simplify your invoice processes and improve visibility by automating manual tasks

Traditional invoice processes can be time-consuming: After receiving a supplier invoice, the accounts payable department must match the invoice against the purchase order and receipt, record it in the accounting system, and code it. Before vendor payment can be issued, the invoice must be approved by the appropriate employee. Finally, every invoice must be stored properly for tax and other purposes.

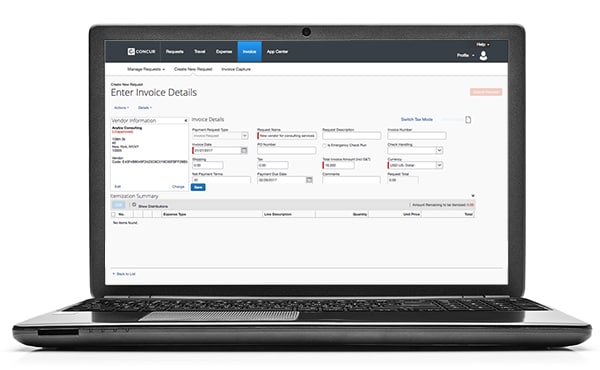

An automated invoice payment processing system like Concur Invoice can make you the hero of AP. Speed up your invoice processing time, reduce the risks of manual processes like fraud and errors, and improve your view of cash flow.

With Concur Invoice, you can:

- Use electronic invoice processing to drive efficiency

- Manage and approve invoices from anywhere

- Immediately send requests to approvers via customized workflows

- Use optical character recognition (OCR) to digitize paper invoices and standardize records

Spend less on invoice processing and management

Spend less on invoice processing and management

Manually processing a single invoice costs $31 on average. More than half of invoices are still received on paper, and significant resources are required to input the data, track down the first approver, and move the invoice through the necessary checks. An invoice automation solution can significantly reduce the time and money spent on invoice processing.

Quickly capture supplier invoices in any format

Quickly capture supplier invoices in any format

Free your accounts payable staff from time-consuming data entry with OCR invoice processing. Optical character recognition technology from SAP Concur uses machine learning to scan mailed, faxed, or printed invoices to automatically populate a payment request. Concur Invoice also captures e-invoices, whether from suppliers, emails, or payment systems.

Faster processing for a timely picture of your spending

Faster processing for a timely picture of your spending

Manually processing an invoice takes an average of 17 days. Invoice automation moves requests for payment into your system more quickly and consistently, so you always have a clear and accurate view of your spending. With business intelligence tools from SAP Concur, you can use that information to make strategic decisions, better manage your cash flow, and take advantage of early payment discounts.

4 unexpected ways manual invoice processing is costing you

If you’re still processing invoices manually, you may be wasting money on unnecessary costs. Processing invoices by hand means:

Time intensive data-entry. As your business grows, so will your AP staff need.

Error-prone invoice management. Lost or mishandled invoices can result in late fees and accounting mistakes.

Poor cash flow visibility. Slow processing makes it difficult to see your liabilities.

Fraud and compliance risk. It can be difficult to ensure proper chain of custody or separation of duties.

Automation delivers an average reduction in invoice processing costs of 29.2 percent.”

Contact us about a better way to handle spend management

Complete the form to have a sales representative contact you, or call +1 (888) 883-8411 today.

Thank you for contacting us about a better way to manage travel, expenses or invoices.

We have received your request for information, and we will be in touch with you soon.

5 tips for building a supplier invoice policy

The best supplier invoice policies work for both your suppliers and your organization. Crafting a policy that works for everyone takes some effort up front but saves you significant time when processing invoices. Best practices when developing your requirements include:

Be clear and direct. Compliance starts with a policy that’s simple and easy to understand.

Solicit feedback. Ask stakeholders from other departments to contribute so your policy works for everyone.

Be considerate. Be aware of how busy your colleagues are; one extra step may feel like a big ask.

Optimize with technology. A cloud-based invoice processing solution can save your organization time and money.

Go mobile: Make your policy easy to follow by allowing employees to manage invoice-related tasks from their mobile devices.

Once created and enforced, an effective policy will greatly reduce the amount of time related to the tasks of approving and processing vendor invoices.”