App Center

Finkraft.ai for Concur Invoice

Automate complex GST processes to save taxes and claim the maximum input tax credit.

Easily connect your Finkraft account with SAP Concur solutions to ensure that your expenses and invoices are matched with GST and vendor data from your ERP and experience an automated, efficient, and hassle free input tax credit (ITC) claim.

Benefits:

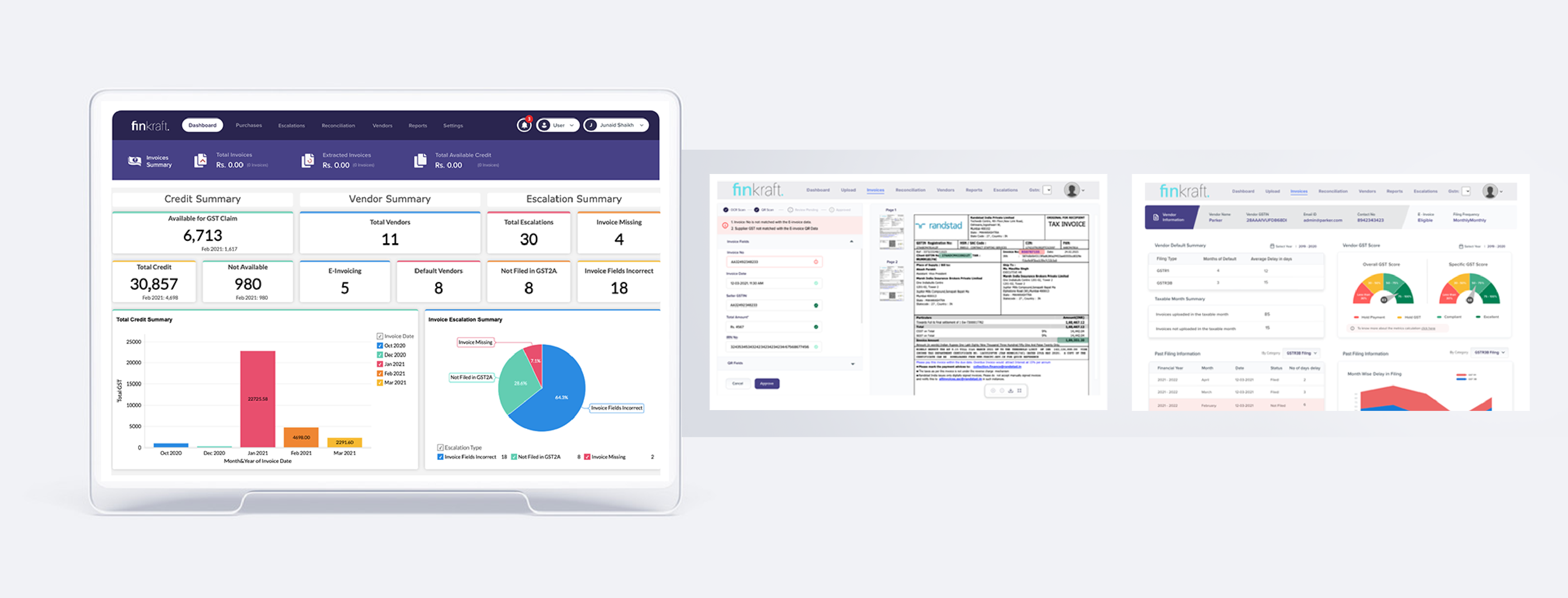

Simple and user-friendly dashboard to view GST credit summary and vendor information. Clear and understandable reconciliation reports of expenses and invoices with GST and vendor data to facilitate the GST ITC process. Graphical information to help finance and tax teams better understand the insights to make informed decisions.

How it works:

Businesses simply upload all pdf invoices directly into Concur Invoice following their normal process. Finkraft.ai then fetches the expense attachments and scans each one.

Each invoice is scanned and the GSTIN number and QR code are successfully extracted. Within the Finkraft.ai portal, businesses can view the detailed reconciliation report to understand an overview of missing invoices, mismatches in data, eWAY Invoices bill status, and invoices that are not filed by the vendors. The Finkraft.ai AI Engine identifies the mismatches and escalates them to vendors by mail. Corporate can view the details of the escalations like escalation type, status of escalation, mail delivery, and timestamp.

Businesses can link their Finkraft.ai portal to GST servers to fetch the GST filing data. This ensures real-time processing of invoice validations and quick reconciliation. Corporate can then view the downloaded GST filing data details in the Finkraft.ai portal.

Once the corporate office receives the updated invoice and forwards it to Finkraft.ai, Finkraft.ai reads the QR, extracts the invoice fields, and matches it with the respective mismatch/missing data record. The system then automatically updates the reconciliation table and resolves the escalation. The invoice missing status will be changed to invoice received.

Corporate can view analytics on the dashboard to see an overview of the credit summary, including credit available for claiming the GST, vendor information like number of eligible and defaulting vendors, reconciliation data, escalations raised for mismatches, and access reports on a weekly/monthly basis. Graphical views help the finance team better understand the insights to make informed decisions.

To learn more about how Finkraft.ai can help your organization maximize your ITC claim, visit the website using the link below, or submit a request for more information.

Works with these SAP Concur solutions:

- Invoice - Standard

- Invoice - Professional

Regions Available:

- Anguilla

- Antigua And Barbuda

- Aruba

- Bahamas

- Barbados

- Bermuda

- Canada

- Cayman Islands

- Costa Rica

- Dominica

- Dominican Republic

- El Salvador

- Grenada

- Guadeloupe

- Guatemala

- Haiti

- Honduras

- Jamaica

- Martinique

- Mexico

- Montserrat

- Netherlands Antilles

- Nicaragua

- Panama

- Puerto Rico

- Saint Barthélemy

- Saint Kitts and Nevis

- Saint Lucia

- Saint Martin

- Saint Pierre and Miquelon

- Saint Vincent and the Grenadines

- Sao Tome and Principe

- Trinidad and Tobago

- Turks and Caicos Islands

- United States of America

- British Virgin Islands

- Virgin Islands, U.S.

- Argentina

- Belize

- Bolivia

- Brazil

- Chile

- Colombia

- Ecuador

- Falkland Islands (Malvinas)

- French Guiana

- Guyana

- Paraguay

- Peru

- Saint Helena

- South Georgia and the South Sandwich islands

- Suriname

- Uruguay

- Venezuela

- Afghanistan

- Åland Islands

- Albania

- Algeria

- Andorra

- Angola

- Armenia

- Austria

- Azerbaijan

- Bahrain

- Bailiwick of Guernsey

- Belarus

- Belgium

- Benin

- Bosnia and Herzegovina

- Botswana

- Bulgaria

- Burkina Faso

- Burundi

- Cameroon

- Cape Verde

- Central African Republic

- Chad

- Congo, The Democratic Republic of the

- Congo

- Cote D'Ivoire (Ivory Coast)

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Egypt

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- European Union

- Faeroe Islands

- Finland

- France

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Holy See (Vatican city state)

- Hungary

- Iceland

- Iraq

- Ireland

- Israel

- Italy

- Jordan

- Kenya

- Kuwait

- Latvia

- Lebanon

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macedonia

- Malawi

- Mali

- Malta

- Mauritania

- Mauritius

- Mayotte

- Moldova

- Monaco

- Morocco

- Mozambique

- Namibia

- Netherlands

- Niger

- Nigeria

- Norway

- Oman

- Pakistan

- Poland

- Portugal

- Qatar

- Romania

- Russia

- Serbia

- San Marino

- Saudi Arabia

- Senegal

- Yugoslavia

- Serbia and Montenegro

- Seychelles

- Sierra Leone

- Slovakia

- Slovenia

- Somalia

- South Africa

- South Sudan

- Spain

- Sudan

- Svalbard and Jan Mayen

- Eswatini

- Sweden

- Switzerland

- Tanzania

- Togo

- Tunisia

- Turkey

- Uganda

- Ukraine excluding Crimea Region/Sevastopol, the so-called Donetsk People’s Republic (DNR) / Luhansk People’s Republic (LNR)

- United Arab Emirates

- United Kingdom

- Yemen

- Zaire

- Zambia

- Zimbabwe

- American Samoa

- Australia

- Bangladesh

- Bhutan

- British Indian Ocean territory

- Brunei

- Cambodia

- Caroline, Mariana, Marshall Is

- Peoples’ Republic of China

- Christmas Island

- Cocos (Keeling) Islands

- Comoros

- Cook Islands

- East Timor

- Federated States of Micronesia

- Fiji

- French Polynesia

- French Southern Territories

- Guam

- Guinea

- Guinea Bissau

- Heard Island and McDonald Islands

- Hong Kong SAR of China

- India

- Indonesia

- Japan

- Johnston Island

- Kazakhstan

- Kiribati

- Korea, South (Republic of Korea)

- Kyrgyzstan

- Laos

- Macau SAR of China

- Madagascar

- Malaysia

- Maldives

- Northern Mariana Islands

- Marshall Islands

- Mongolia

- Myanmar

- Nauru

- Nepal

- New Caledonia

- New Zealand

- Niue

- Norfolk Island

- Palau

- Palestine

- Papua New Guinea

- Philippines

- Pitcairn

- Reunion

- Samoa

- Singapore

- Solomon Islands

- Sri Lanka

- Taiwan of China

- Tajikistan

- Thailand

- Timor-Leste

- Tokelau

- Tonga

- Turkmenistan

- Tuvalu

- USA Minor Outlying Islands

- Uzbekistan

- Vanuatu

- Vietnam

- Wallis And Futuna

- Western Sahara