App Center

Finkraft.ai for Concur Expense

Automate complex GST processes to claim the maximum input tax credit on expenses.

Easily connect your Finkraft account with SAP Concur solutions to ensure that your expenses and invoices are matched with GST and vendor data from your ERP and experience an automated, efficient, and hassle free input tax credit (ITC) claim.

Benefits:

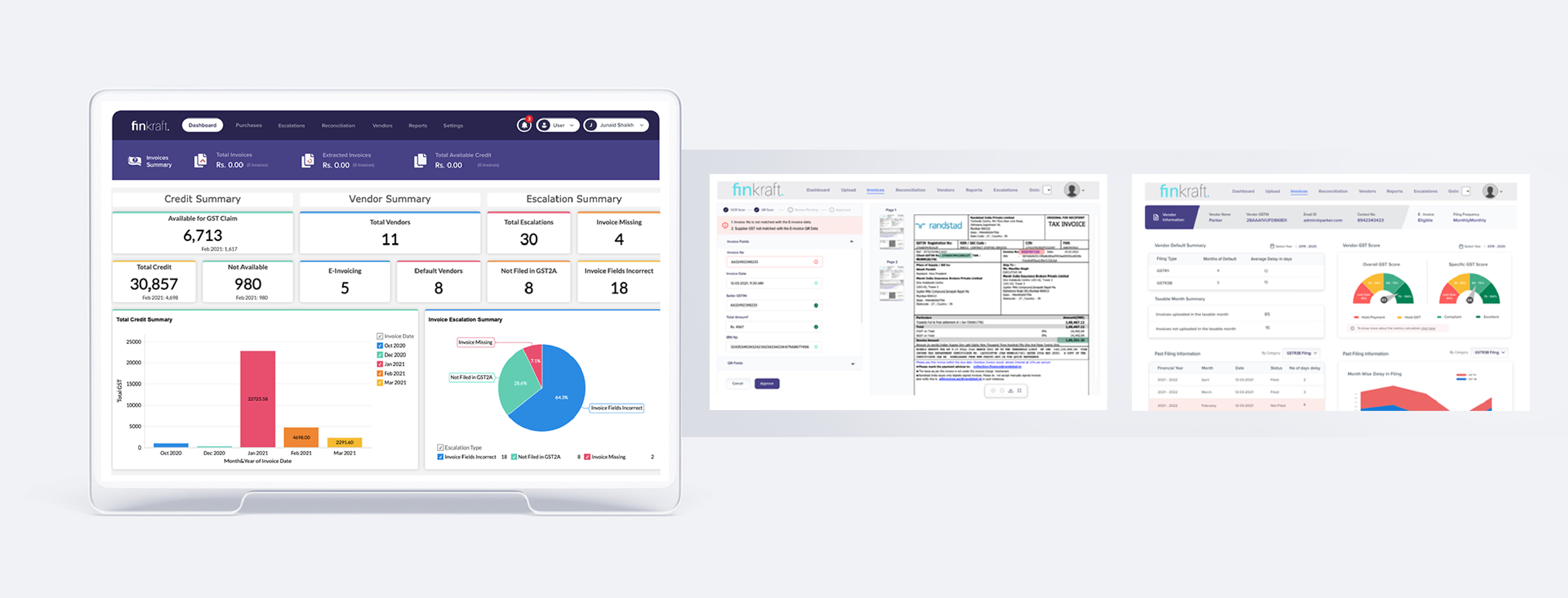

Simple and user-friendly dashboard to view GST credit summary and vendor information. Clear and understandable reconciliation reports of expenses with GST and vendor data to facilitate the GST ITC process. Graphical information to help finance and tax teams better understand the insights to make informed decisions.

How it works:

Businesses can simply upload all expense images and PDFs directly into Concur Expense following their normal process. Finkraft.ai then fetches the expense attachments and scans each one.

Each expense is scanned and the GSTIN number and QR code is successfully extracted. Within the Finkraft.ai portal, businesses can view the detailed reconciliation report to understand and overview of missing expenses and invoices, mismatches in data, eWAY Invoices bill status, and invoices that are not filed by the vendors. The Finkraft.ai AI Engine identifies the mismatches and escalates them to vendors by mail. Corporate can view the details of the escalations like escalation type, status of escalation, mail delivery, and timestamp.

Businesses can link their Finkraft.ai portal to GST servers to fetch the GST filing data. This ensures real-time processing of expense and invoice validations and quick reconciliation. Corporate can then view the downloaded GST filing data details in the Finkraft.ai portal.

Once the corporate office receives the updated expense or invoice and forwards it to Finkraft.ai, Finkraft.ai reads the QR, extracts the expense fields, and matches it with the respective mismatch/missing data record. The system then automatically updates the reconciliation table and resolves the escalation. The expense missing status will be changed to invoice received.

Corporate can view the analytics on the dashboard to see an overview of the credit summary, including credit available for claiming the GST, vendor information like number of eligible and defaulting vendors, reconciliation data, escalations raised for mismatches, and access reports on a weekly/monthly basis. Graphical views help the finance team to better understand the insights to make informed decisions.

To learn more about how Finkraft can help your organization maximize your ITC claim, submit a request for information.

Works with these SAP Concur solutions:

- Expense - Standard

- Expense - Professional

Regions Available:

- India