Fraud and Compliance

Bumpers for Budget? Leverage Expense Category Summaries to Keep Spend on Track

While budget management is certainly complex and highly specific to each organization, being proactive with budget management reduces operational interruption by keeping an organization’s cashflow adaptable to change. However, how do we actually do it?

SAP Concur data experts always recommend keeping your Expense Category Summary data handy to maintain bumpers for your budget and stay on track. Once you have your own data ready, it’s easier to compare yourself to peers in your industry using benchmarks and our spend management assessment tool! That way, you’re ready to adjust spend within the current budget year as needed, while also building out a plan for the next budgeting season.

Although control of employee discretionary spend – items such as home office expenses, mileage, meals, or seminar registration – certainly has changed, with clear education on expense type categorization and an efficient approval process, spending can stay within existing budget allocations or be adjusted with minor interruption to business operations. Here are some recommendations on how to maintain a healthy budget to stay agile and resilient in the years to come.

Setting goals for a healthy budget

1. Verify spending is aligned with your budget

Comparing expense category spend to budget allocation may uncover challenges in spend management. When you compare a report of your expense types year over year, it’s fairly easy to identify the highest spend categories – that is, as long as your team is accurately reporting them! A recent Forrester report indicated that “60% of IT decision makers are unsatisfied with their T&E reporting and analytical capabilities. Similarly, the greatest challenge managers face with current T&E and invoice solutions is poor visibility of actual and projected spend against budgets.”

Educating employees and using audit rules on expense policy spend categories are fundamental to effectively managing spend against budget – both in the short and long term. When employees submit properly categorized expense reports the first time, managers can verify that the spend that they are approving aligns with their operating budget and that the correct categories are reported. This accuracy, in turn, will illuminate trends and cashflow status.

2. Maximize the value of a single platform

While allowing employees a certain level of autonomy is valuable, providing them with multiple options to report expenses can cloud your visibility, particularly when an emergency occurs and there is a temporary gap in the utilization of expense reporting. According to a spend management poll of 500 finance leaders from businesses of all sizes, “75% of finance leaders say their business often exceeds expense, travel, and invoice budgets. And even more agree that their expense, travel, and invoice systems need to be better connected for a single view of spend.” Maximizing the use of a single platform keeps both the process and the data as clean as possible.

3. Ensure the alignment of spend and goals

Once you understand the total year-over-year expense spend of your organization, you’ll be able to identify trends over time. This helps you build a budget and plan that everyone can stick to. According to the 2020 Global Business Traveler Report, “97% of business travelers expect a “new normal” with changing norms and practices.” Equipping decision-makers on your team with accurate expense type data will empower them to make the right choices for your organization’s successful budget management and overall operational performance.

Expense category benchmarks for budgeting: How do you compare?

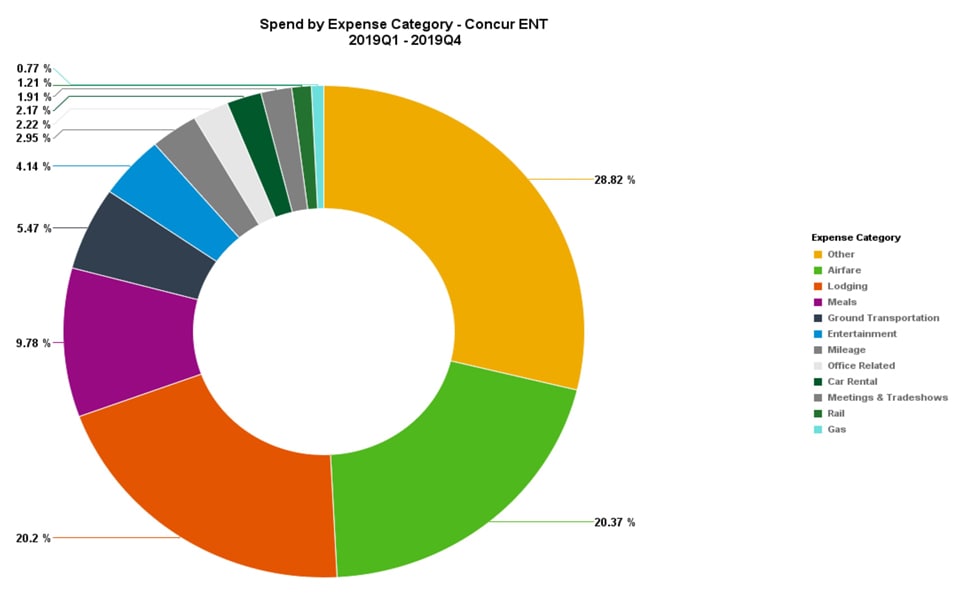

Once you have leveraged our best practices, we recommend that you regularly run a report of your Spend by Expense Category. You’ll be better able to reduce budget overages through this level of granularity.

Let’s see how you compare:

Best practices to keep spend within budget

After comparing your expense categories to those of other SAP Concur customers, here are some best practices to keep your organization’s spend aligned with your budget:

- Submit expenses in the time period in which they occurred

- Observe real-time spend to budget access

- Control spend before it occurs

- Integrate travel program to expense tool, and reduce “invisible” spend

- Allocate P-Card spend as soon as it occurs

- Maximize corporate card use

- Distribute Actual vs Budget Spend reports to department managers on a weekly cadence

- Automate mileage expense submission

Assess your spend management with our handy tool

Use our handy spend management assessment tool to determine how your systems measure up against other businesses, and find out your own business’ maturity stage. You will also learn what you can do to take these processes to the next level. Download your results upon completion to better manage spend against budget today.