New Global Survey Highlights COVID-19 Impact and Outlook on Business Travel

Research reveals that 59% of global business travelers expect to feel positively about their next business trip after the COVID-19 outbreak.

New research commissioned by the SAP Concur organization in May – June 2020 provides important insights that are shaping a new normal for business travel. The data suggests travel will continue to play an irreplaceable role in meeting critical business demands. However, travelers’ health and safety, and a new era of trip preparation and policies, will be front and center as travel resumes.

Notable highlights of the responding 4,850 business travelers in 23 global markets and 800 travel managers in eight global markets include:

Business travelers expect to feel a mix of emotions about their next trip:

- Fifty-nine percent of business travelers expect to feel positively about their next business trip.

- The most common emotions that business travelers expect to feel during their next business trip include worry (39%), excitement (32%), anxiety (30%), and relief (24%).

- More U.S. business travelers expect to feel excited than the global average (41% compared to 32%).

- Forty-five percent of business travelers identified the trip itself to be the most stressful stage of business travel, a 50% increase from last year.

Business travelers expect an increase in discrimination of certain groups while traveling:

- Globally, groups expected to face increased discrimination include those who visibly display cold/flu-like symptoms (59%), those from countries with greater than average infection rates (49%), and travelers of Asian descent (32%).

- In the U.S., 94% of business travelers expect increased discrimination against certain groups, including those who visibly display cold/flu-like symptoms (59%), those from countries with greater than average infection rates (53%), and travelers of Asian descent (40%).

- The older the business traveler, the less likely they are to expect increased discrimination against certain groups (95% of Gen Z compared to 84% of Boomers).

- Those who self-identify with groups that more often face discrimination in society are more likely to expect increased discrimination against certain groups, including LGBTQ+ (95% compared to 90% of non-LGBTQ+) and those with special needs and underlying health conditions* (95% versus 89% of those without).

Companies must overprepare to meet emerging traveler expectations and address less predictable travel conditions in the future:

- Among surveyed travel managers, 96% reported that their company was not fully prepared to manage evolving travel demands during the outbreak.

- Biggest pain points include handling the volume of canceled reservations (44%); processing the volume of refunds, receipts, and unused tickets (43%); and determining if it is safe to travel in the absence of government guidelines (40%).

- SMB travel managers (41%) are more likely to say their company is unprepared to provide safety guidelines to travelers than those from larger businesses (33%).

COVID-19 has changed the health and safety conversation, putting it front and center for all travelers:

- Ensuring personal health and safety while traveling is most important to business travelers, with 65% placing it in their top three considerations.

- Top concerns about returning to business travel also include infecting their families (55%) and getting sick themselves (53%).

- In 2019, women and LGBTQ+ travelers reported increased concerns about personal safety while on the road. The new normal in 2020 has narrowed the gap, bringing personal health and safety to the forefront for men, women, and LGBTQ+ travelers (36%, 41%, and 30%, respectively).

Business travelers hold themselves, then their employers, most accountable for ensuring their health and safety while traveling:

- Globally, 36% will hold themselves most accountable to protect their health and safety when they can travel, 18% will hold their employer most accountable, and 13% will hold their government most accountable.

- U.S. business travelers are most likely to hold themselves accountable to protect their health and safety when traveling (37%), followed by their employer (17%), their travel agency/travel management company (14%), transportation providers (13%), and their government (10%).

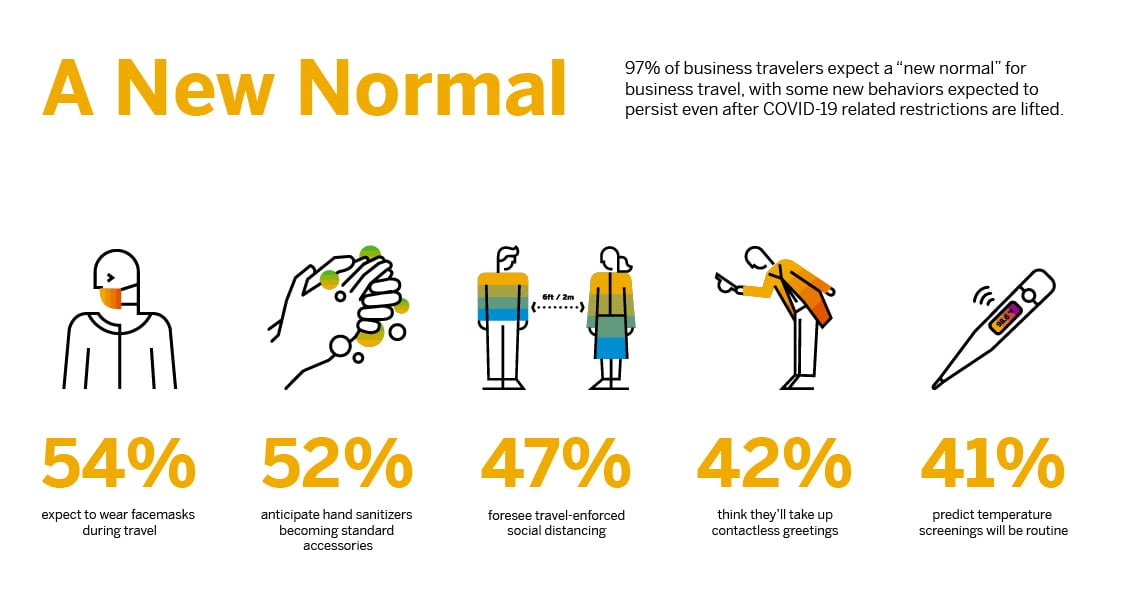

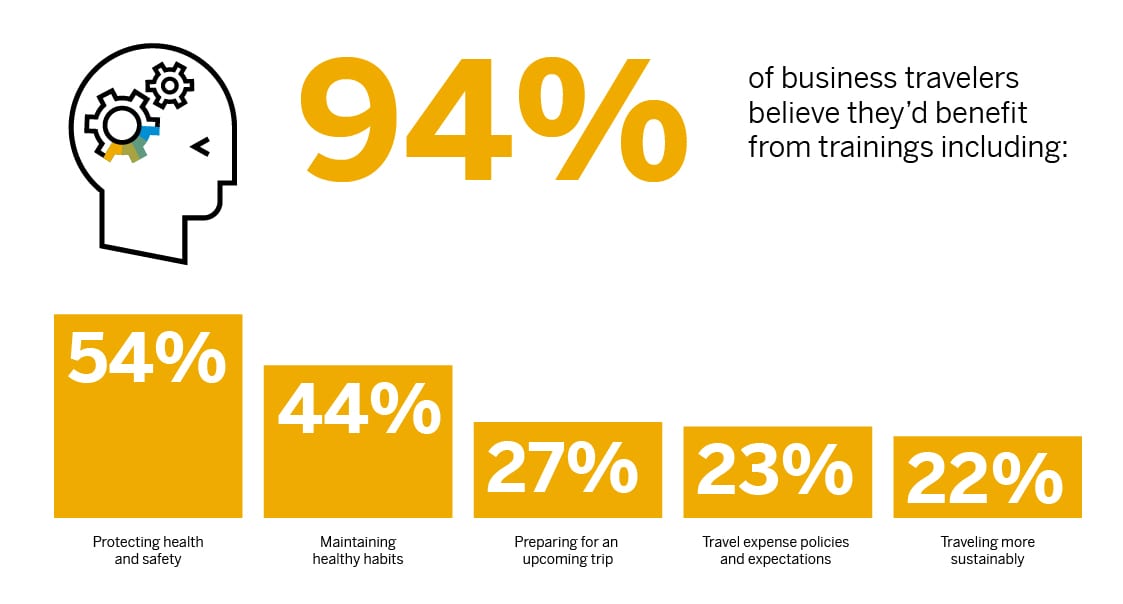

New traveler behaviors and company policies to protect employees’ health and safety will be required at every stage of the business trip:

- Ninety-six percent of respondents identified at least one measure they consider to be critical for their company to implement when travel resumes, including mandatory personal health screenings for traveling employees (39%), limiting business travel to only the most business-critical trips (39%), and easier access to personal protective equipment like gloves or facemasks (33%).

If companies do not adapt, most employees intend to act:

- Globally, 65% of business travelers intend to take some degree of action if their employer does not implement new measures as they return to business travel, such as asking to limit or reduce travel in their current position (45%), searching for a new position within their company that does not require travel (10%), or searching for a position at a different company (8%).

- Globally, nearly one in five (18%) plan to look for a new role, inside or outside the company, that does not require travel if measures aren’t implemented.

- In the U.S., nearly one in four (23%) plan to look for a new role, inside or outside the company, that does not require travel if measures aren’t implemented.

While remote work has become more normalized, employees feel travel still plays an important role in the success of today’s enterprise:

- Ninety-two percent of business travelers expect their company to experience negative outcomes due to travel restrictions around COVID-19, including a reduced number of deals or contracts signed that require in-person interactions (52%) and declines in new business wins that require in-person sales meetings (46%).

- The younger the business traveler, the more likely they are to expect negative outcomes to their company associated with recent travel restrictions (96% of Gen Z versus 86% of Boomers).

Emerging expectations around personal and community health and safety will mean a new era of decisions, processes, and innovations across the travel industry. These survey findings underscore that the industry must come together to collectively adapt, stabilize, and reimagine the world of travel.

For more information, please download the full white paper here.

“The scope of the COVID-19 travel disruption has magnified common travel and expense challenges in a way that is unprecedented. Traditional challenges, like ensuring necessary oversight of employees’ business travel plans, rapidly became complex for employers amid ongoing restrictions that remain unpredictable,” said Mike Koetting, Chief Product Strategy Officer, SAP Concur. “Businesses need to be proactive about supporting and safeguarding employees as they prepare to travel again for work, whether putting pre-trip approvals and guidance in place or ensuring visibility into itineraries and spend information, wherever employees book travel.”

TripIt from Concur recently launched a Traveler Resource Center, making it easy for travelers to find the latest global travel advisories, guidelines, and restrictions, alongside other helpful resources so they have the information they need before they get back on the road.

As we continue to explore what’s next, the SAP Concur Travel Industry Summit – a one-day event on September 17, 2020, that is open to the business travel industry community with no registration fee – will encourage cross-industry, government, and business community dialogue around a new era of travel, timely content and resources, and community engagement to address the current and future needs of business travel. Registration is open, and we encourage interested parties to participate in these important, industry-shaping conversations.

*For the purposes of this survey, “special needs” referred to those who have chronic physical, developmental, behavioral, emotional, or autoimmune conditions that require special health and related services.

The survey was conducted by Wakefield Research (www.wakefieldresearch.com), a leading independent provider of quantitative, qualitative and hybrid market research, among 4,850 business travelers defined as those who travel for business three or more times annually from the following markets: US, Canada, Brazil, Mexico, UK, France, Germany, ANZ region (Australia, New Zealand), SEA region (Singapore, Malaysia), Greater China, Hong Kong, Taiwan, Japan, India, Korea, Italy, Spain, Dubai, Benelux (Belgium, Netherlands, Luxembourg), Sweden, Denmark, Norway, and Finland. Additionally, Wakefield Research surveyed 800 travel managers from the following markets: US, Brazil, Mexico, UK, France, Germany, SEA region (Singapore, Malaysia), and Hong Kong. Both surveys took place May – June 2020.