Aberdeen Insights: The T&E Road to Recovery and Growth, Part 1

During a recent Aberdeen webinar, Vice President and Group Director Bryan Ball, revealed the roadmap for success when it comes to companies navigating how to manage their travel and expenses (T&E) during these uncertain times.

According to Ball, finance and travel managers who oversee or manage their T&E programs need to examine, “how to best support their resiliency and business continuity efforts for their companies through recovery to growth and prosperity.” The strategy and actions companies take now to manage their T&E programs will lead them to better outcomes and show value back to the business.

In this first part of our three-part Recovery & Growth series, we’ll discuss some of the research findings shared by Ball and insight from guest panelists:

- Rowena Froegel, Finance Operations Senior Manager of Corporate Accounts Payable at Discover Financial

- Jeanne Dion, Senior Value Consultant at SAP Concur solutions.

What pressures are T&E teams facing?

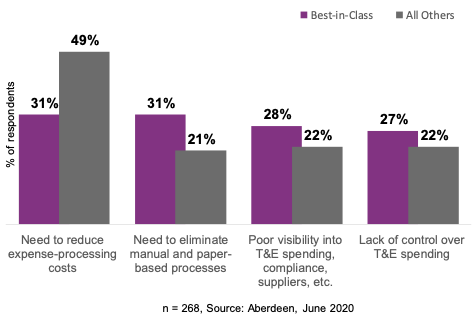

What separates the best-in-class (top 20%) companies from the rest is their commitment to upholding the fundamentals, while still grasping hold of the bigger picture. Instead of only focusing on decreasing costs (31%), these top performers are also focusing on ways to control spend (27%), improve visibility (28%), and eliminate manual processes (31%). By doing so, they are essentially saving costs. With more control, best-in-class companies are gaining visibility into spending, enabling them to make even more informed decisions and accurate cash flow projections. Increased control also allows for better policy adherence, so that they aren’t unnecessarily losing money.

What capabilities for recovery will be important?

As companies move to recovery, Aberdeen finds that these two core capabilities will be critical:

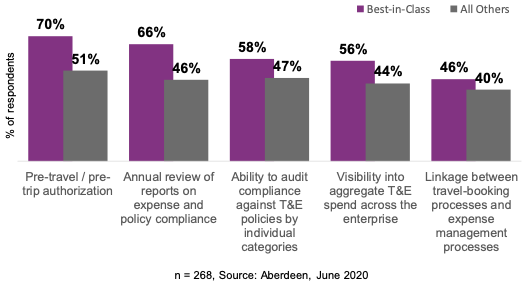

- Pre-travel authorization: As companies phase back travel and additional spend they will want to keep managing this closely. “Pre-travel authorization will be important as companies come back,” said Ball. Almost three quarters (71%) of organizations are currently using this capability.

- Visibility into total spend: More than half (56%) of companies have an aggregated view of both travel and expense. “The value of visibility during recovery is that you get visibility to your cash flow more quickly,” said Ball. Without this, companies fail to make decisions quickly which can leave them to become almost crippled.

“Some companies are finding this [pre-spend tools] more of a need now for safety reasons during the pandemic,” says Jeanne Dion. “However, the reality is that it is a critical spend control tool. You can’t control compliance after the spend has occurred. Whether you’re using an online booking tool that feeds directly into your expense tool or a machine learning tool to catch exceptions, you can see what happens from when the spend was authorized to when it occurs.”

What is the ROI?

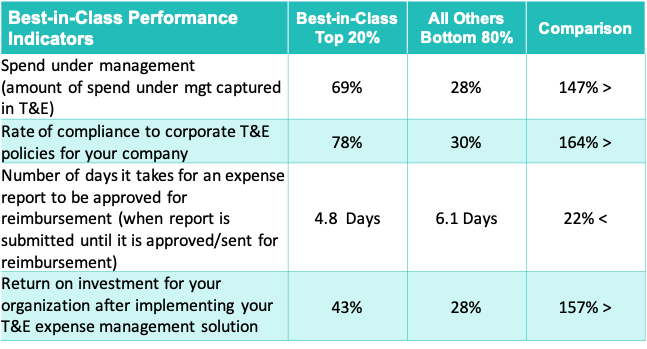

Top-performing companies are 41% more likely to capture spend under management (see “Best-in-Class Performance Indicators” chart below) than others. This is significant because, “If you can’t see the spend in T&E, obviously visibility is a problem. It comes in as a random expense through some type of expense reporting or invoice that shows up. But the more you can control the spend, you get the preferences driven by the T&E system your company is using,” said Ball. That means more visibility from the very start and less digging through expenses to try and re-define them later on.

After implementing a new T&E solution, companies experience a 48% return on their investment (ROI). Ball explains that companies who get a higher return are those who can capture spend under management in their T&E area, achieve compliance to their policies, and shorten the overall cycle time – from creation of the report to reimbursement.

Defining the leaders – maturity performance matrix

Best-in-Class Companies Demonstrate Superior Performance

What are best-in-class companies keeping in focus?

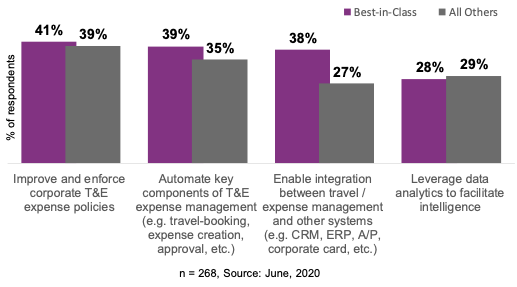

A key move that the best companies make is that they stay focused on the basics, even though they already do these things well. By constantly seeking to improve the most basic processes, they save big in the long run and are primed for success. Here are some of the ways these companies are remaining focused even in the current environment:

- Improving and enforcing corporate T&E expense policies. By consistently reviewing policies, the best-in-class businesses can be sure that all processes are up to date and efficient.

- Automating key components of T&E expense management. By improving the automation of T&E management, teams can focus on high value tasks. Process time is thus shortened, and spend visibility is heightened.

- Enabling integration between travel/expense management and other systems. Better integration improves automation and cuts down on the manual errors that plague T&E management. Overall the effects are improved process speeds, compliance, and visibility.

- Leveraging data analytics to facilitate intelligence. Properly leveraging data will give your business insights to make more informed decisions.

“When you use one platform for your travel and expenses and feed it into other systems for single source of truth, you eliminate errors and speed up your compliance, processes and close,” says Dionne. “This will give you a greater ROI and ability to leverage your analytics.”

How SAP Concur solutions can aid recovery and growth

Managing a business means managing change. And with well-managed cash flow so critical to every company’s success, you’ll want to recognize when a change is needed so you can make adjustments along the way to stay ahead of problems before they become serious. With SAP Concur solutions, you can simplify how you manage and control employee spend by automating and integrating the travel, expense, and vendor invoice process into a single, connected experience. That way you can see all of your spend data in one place, while helping employee comply with spending policies.

For more insight on the road to recovery and growth when it comes to T&E management, listen to this Aberdeen webinar. Then stay tuned for the second part of our blog series.