Control Company Costs

Maximizing Corporate Card Rebates: Our 80/20 Rule

An immediate way to get a pulse on who, how, and when your organization’s dollars are being spent –what we call spend governance – is to look at your corporate card usage. The perks of maximizing corporate card rebates go beyond optimizing cash flow to things like improving employee satisfaction, increasing spend transparency, and policy compliance. What’s the translation? More money, happier employees, and fewer rules broken.

Leveraging the 80/20 Rule

Before digging into your organization’s initiatives, we strongly encourage using the best practice for corporate cards to be set at 80%, while cash spend is limited to 20% of all transactions. This will save your organization hours of authentication prior to approval. According to a JP Morgan study: “With an automated system, there’s an even greater benefit in heightened productivity of clerical staff…companies that offer electronic expense reporting are much more likely to use data mining to flag out-of-policy spend or card misuse.”

When employees use their corporate credit cards, you gain the benefit of receiving feeds directly from the financial institution on the day that transaction is posted, granting visibility on amounts-due and payment-due dates. By having advance visibility on charges coming their way, department heads can ask their employees to withhold spending until the next cycle or spend within the current budget if it allows that department to stay within budget from one cycle to the next. And voila! Efficient spend governance is enhanced.

Big Money: The formula to calculate your corporate card rebate

Now, here’s the fun part. Use this formula to help you calculate the dollars you’ll get back when you maximize your corporate card rebates to their fullest potential:

(TOTAL CASH SPEND * AMOUNT TO MOVE TO CARD (AS A PERCENTAGE)) * REBATE PERCENTAGE FROM CARD PROVIDER = REBATE DOLLAR AMOUNT

Doesn’t that sound like a lot of money just sitting there waiting to be added to your organization’s bank account? We think so! The greater the spend on your corporate cards, the higher potential rebate dollars back for you to reinvest into your business.

Industry benchmarks for corporate card adoption: How does your organization compare?

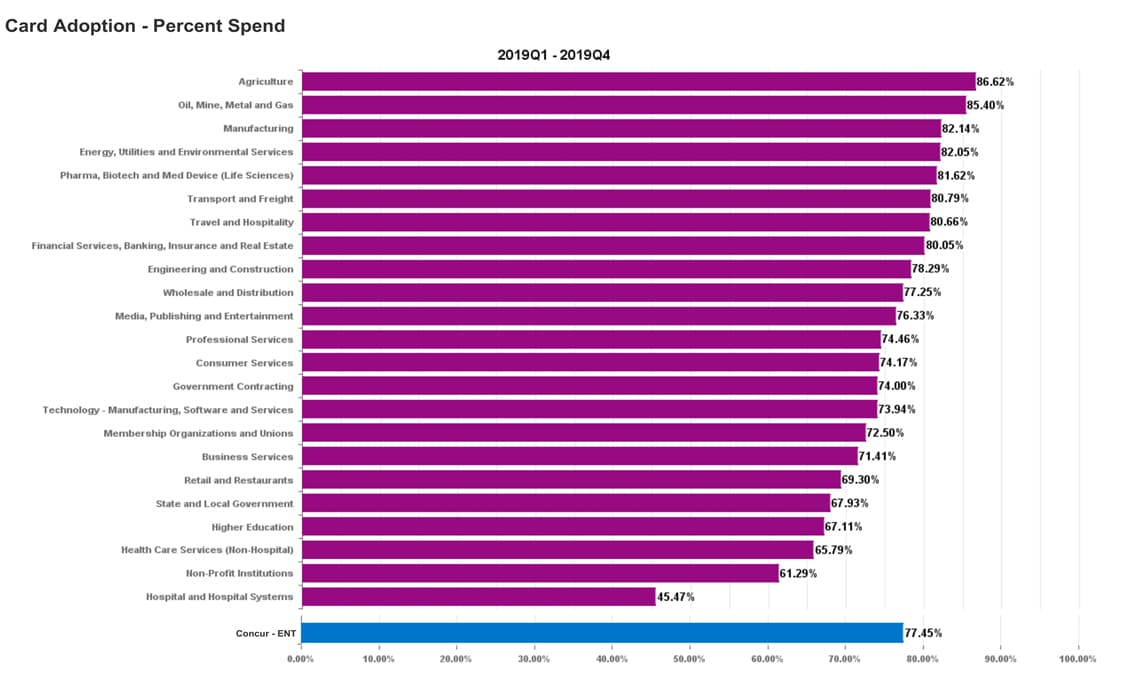

While every organization is unique, knowing the corporate card adoption percentage rate by industry provides a frame of reference as to whether or not your organization meets the general trends.

Now, when your colleagues express that increasing corporate card adoption is impossible due to limitations unique to your industry, you can base your recommendation off of increasing corporate card adoption with compelling data. Just pull a report of your corporate card adoption spend percentage and compare it to these industry benchmarks so you have a more compelling case.

Pro tip: Corporate cards

When employees use corporate cards, everyone wins. Your organization gains visibility into who spent what, where, and why every time an employee uses their corporate card to pay their invoices and expenses.

Here are some do’s and don’ts that can help change how employees submit expenses:

Do:

- Use the SAP Concur mobile app receipt capture and approval capabilities to streamline and automate processes when possible

- Encourage immediate expense reporting when cash is used.

Don’t:

- Accept cash expenses without a receipt to help encourage card usage.

- Reimburse cash transactions older than 60 days.

We’re glad that your interest is piqued. Corporate cards are a great way to empower employees while gaining greater control and visibility over spend. If maximizing corporate card rebates is one of your organization’s goals, we’re here to help. Contact us today to start maximizing your corporate card rebates!