Reactive, Random, or 100% Manual: Which Auditing Type Are You?

Auditing is a powerful and fundamental operation for every organization. But how much money and time should be spent on it, and how do you measure accuracy? Once you have audit results, which operations do you adjust first to have the greatest impact? Having the proper tools, processes, and procedures in place to successfully audit expenses enables you to get the most of out your time and dollars spent on auditing.

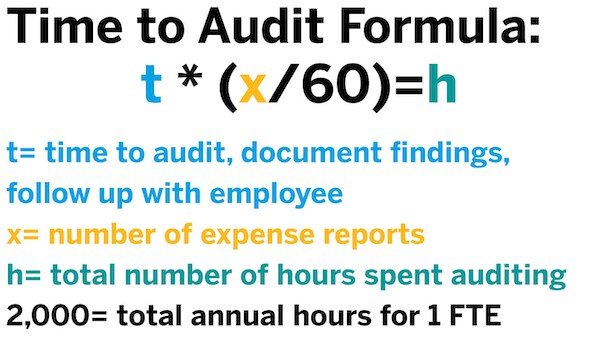

Time on task: How much does a manual audit actually cost?

YES, you can calculate the estimated cost to perform all tasks related to manual expense report auditing; so logically, improving efficiency lowers cost. The benefit of this calculation is to quickly determine if this is how you want to invest your most valuable resources time (your employees) or if it makes sense to automate or outsource some of the work – allowing your employees to focus on other areas of your organization. A recent IDC report found that Concur Invoice customers saw benefits like: 46% more efficient invoice handling staff, 75% less time to process an invoice, and 45% more efficient AP teams.

Here’s our handy formula:

Non-compliant spend happens in every business and audits are essential for catching that spend. Having the proper tools, processes, and procedures in place to successfully audit expenses will optimize auditing efficiency and accuracy. Typically, organizations are using audit methods that fall into one of the three categories:

- Reactive: Audits are initiated only when fraud is suspected

- Random: Manual audits are conducted on a random sample of expense reports

- 100% Manual: Manual audits are conducted on all expense reports. While effective at finding fraud, this method is the most difficult, expensive, and time consuming.

Exploring options as to whether it is more cost-effective to outsource auditing, implement automation, or better support in-house auditing teams are all things to consider.

Auditing best practices to leverage

Evaluating your expense categories to determine which areas, teams, or categories require more or less of your auditing attention will help you optimize your organization’s auditing efficiency. Consider things like: clarifying expense submission procedures and creating automated rules around approvals or notifications, supported by consistent and scalable policies. Here are some of our best practices to get your auditing process on-track:

1. Identify Improvement Opportunities: Number of Exceptions by Expense Type: Examine which expense types are most frequently causing exceptions and address the root of the cause (examples: misunderstanding of policy, mis-categorizations, overly stringent audit rules)

2. Reduce Number of Exceptions Over Time: Trend of Audit Rule Exceptions: The number of exceptions in an expense report significantly increases the amount of time your team spends auditing it. Decreasing this trend may reduce the burden on audit resources and increase employee productivity.

3. Improve First Pass Ratio: Multiple Touches: Expense reports that repeatedly cycle between submitter, approver, processor, and auditor are costly. The best-case scenario is that most reports go through the process only once.

4. Increase Card Adoption: Spend Channel Adoption: Card feeds ensure the accuracy of amounts submitted and reduce the need for manual validation. Making cards your preferred payment method when employees are spending company dollars simplifies the auditing process.

Finance Personality test: Which auditing type are You?

So, after reading our best practices, which auditing type are you? Take our Finance Personality test to see where you stand.