Growth and Optimization

Achieve Your Business Outcomes with Intelligent Spend Management

When you’re building a business that can withstand the challenges of today, it helps to find smarter ways to run your organization. It’s important to address how employee spend is changing, find ways to mitigate fraud, maximize your visibility into cash flow, discover ways to control low-level expenses, and tap into the power of corporate and p-cards.

But you’ll also need to focus on achieving your business outcomes. You can support those efforts by adopting best practices and intelligent spend management processes for your employee-based spend.

What are business outcomes?

Business outcomes are broad goals the organization strives to achieve to meet its commitments to shareholders, employees, clients, and suppliers. When it comes to employee-initiated spend, including travel, expense, and discretionary or low-level spend, we group these business outcomes into three pillars:

- Controls and compliance

- Spend visibility and management

- Employee satisfaction and workforce engagement

For instance, shareholders benefit when the organization is in control of spend. Employees benefit when tedious administrative and repetitive tasks can be automated so they can spend more time on activities that move the business. And suppliers benefit from timely payments for the goods and services they provide.

What is intelligent spend management?

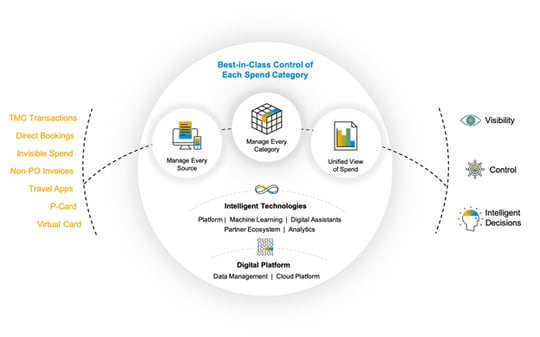

Intelligent spend management of employee-based spend is a comprehensive way for organizations to obtain a unified view of spend. Intelligent spend management consists of managing:

- Every source of spend – such as air travel, auto mileage, non-P.O. invoices, cash payments, services, etc.

- Every category of spend – such as sales expenses, home office expenses, marketing support, supplies, etc.

- A unified view of spend – which benefits multiple functions of the organization’s finance, accounting, and HR departments.

We achieve the above by:

- Capturing data every time money is spent – e.g. through corporate cards, online booking tools, automatic mileage logging, image capture of receipts, etc.

- Categorizing spend as soon as it occurs through the application of rules, artificial intelligence, and machine learning.

- Applying policies for approval routing and payment authorization.

Best practices for intelligent spend management

Capturing spend should be an initial area of focus. Best practices include using mobile devices for scanning receipts and approving expense reports, OCR and machine learning to automate the capture of invoice data, and an integrated system linking travel reservations and expense reporting.

Categorizing spend involves one or more of the following activities: assigning invoices/expenses to departments and project owners; determining the tax treatment of expense; validating that the vendor is in the database of suppliers; and more.

Approaching your spend categorization like this can affect the volume of business your organization is spending on each vendor and the amount of money charged to each corporate department. Best practices for categorizing spend include using automation to record and categorize expense and invoice items, automation of mileage recording and entry, and using corporate cards and P-cards instead of cash.

Policies for approval of reimbursement and payments may include limiting the expense to an allowable range, purchasing from approved vendors, attaching receipts for tax substantiation, obtaining prior approval to the purchase, and so on.

Best practices associated with applying policy include the use of automated tools to detect unusual expenses or reimbursement requests, tools to reject non-conforming p-card charges, and tools to track non-P.O. expenses against approved budgets.

Applying intelligent spend management best practices improves business outcomes

The same best practices associated with intelligent spend also help an organization reach its desired business outcomes of spend visibility and management, internal controls and compliance, and employee engagement and satisfaction.

For instance, practices that minimize under-the-radar travel spend or integrated tools that link bookings and travel expense improve the organization’s spend visibility and management. Practices that include tools to detect unusual expenses or track expenses against approved budgets improve the organization’s internal controls and compliance. And practices that involve automating expense report creation, categorization of invoice items, or mobile tools for receipt capturing and approvals, improve employee engagement and satisfaction.

Best practices in action

By using corporate cards instead of cash, an organization can get rebates up to 1.5% on the spend charged to corporate cards. Integrating the corporate card program with the organization’s T&E management system provides enhanced spend visibility, with daily reports from the financial institution showing employee name, amount charged, vendor name, and other category info.

SAP Concur data shows that automated mileage tracking programs can save up to 21 hours a year, per employee. In addition, organizations that automate their spend management tend to approve expense reports 4.9 days faster, spend less time handling receipts, and can approve expense reports on the go, all of which can lead to higher employee engagement and satisfaction, according to an Aberdeen report.

A 2021 Oxford Economics study found that automation can increase the effectiveness of finance processes by giving leaders more visibility into spending across the organization, creating a “single source of truth,” and increasing efficiency.

Companies that have automated the following processes reported multiple benefits:

- Invoice management – increased agility and resiliency for 43%

- Expense management – increased productivity for 42%

- Cash flow management – increased functional collaboration for 35%

All these benefits support an organization’s business outcomes of increasing agility and efficiency, while strengthening cross-team collaboration.

Successful business outcomes across teams

The best practices associated with intelligent spend management help organizations improve their business outcomes. Those outcomes benefit multiple departments and people in the organization, for example:

- The HR manager benefits from happier employees who can dedicate more time to their functions instead of spending so much

- time on expense reports

- Procurement gains more visibility into opportunities to aggregate spend by vendor or supplier category

- Finance leaders have more visibility into managing cash flow

- The director of compliance can spot non-compliant charges and potential fraud faster

- Accounting will gain increased productivity in data entry and categorization

As each department focuses on the benefits of spend automation and integration tools, it’s important to communicate that value so the organization’s leaders see how automation can support the company’s business outcomes.

For more information on how SAP Concur solutions can help you and your organization, please contact the SAP Concur team.