Control Company Costs

4 Reasons SAP Concur Users Should Care About Their Data

Did you know that your data can deliver real savings on T&E without cutting your budget? Using the latest machine learning and artificial intelligence tools, you can uncover massive savings opportunities through SAP Concur data.

Why is SAP Concur data unique?

On top of automating expense and invoice management, saving time and eliminating manual processes, the added value you get from being an SAP Concur user is access to the unique data collected within SAP Concur- and what's even more interesting is how much you can do with all of that data.

Thanks to SAP Concur, you have information on all of your actual travel spend vs. budgeted, plus you know where the spend is happening- hotels vs. airlines vs. food and beverage- and in which locations around the globe.

With all of that travel, expense, and invoice data in one place, the scene is set to capitalise on instant, real-time, and actionable insights.

What can you do with all of that data?

1. Increase VAT Recovery

The Concur App Center is a goldmine of apps that help you drive smarter spend, easier travel and effortless expensing. And one of the easiest and most rewarding ways to identify big savings is by reclaiming Value Added Taxes (VAT).

Thanks to Taxback International VATConnect and our automated connection with SAP Concur, you can effortlessly identify VAT savings and pump them straight back into your bottom line.

Our VATConnect technology allows us to easily analyze every transaction to provide a clear breakdown of your VAT recovery potential across all entities, transaction types, country of spend, etc.

VATConnect analytics shows you the status of your VAT recovery in real-time, with high-level dashboards, detailed views and the ability to slice and dice the data across many variables.

On average, we increase new client’s VAT reclaim by up to 50%.

2. Identify spending trends and make smarter decisions

Taxback International take it a step further by helping our clients look not only at the VAT they can recover today but at the opportunity for increased reclaim in the future:

- Our continuous improvement program is focused on pinpointing lost VAT opportunity and taking specific steps to drive internal change through employee education programs and tools that improve compliance of receipts and invoices to increase your potential recovery.

- One client doubled their reclaim by simply identifying a specific employee that continually submitted ineligible receipts, which they were able to easily correct by educating that employee on proper receipt capture.

- VATConnect’s prescriptive analytics provide actionable insights to help clients get the highest possible reclaim and improve compliance year after year. Many clients have been able to multiple their VAT recovery tenfold or more.

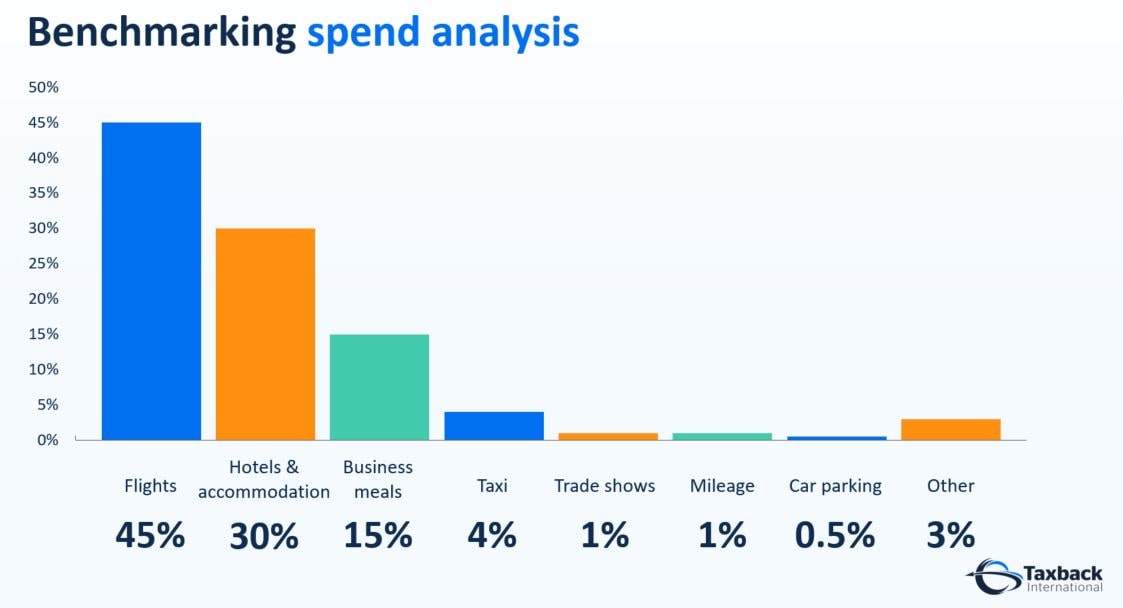

3. Benchmark your spending and streamline your processes

Understanding the characteristics of other travel programs can provide unique insights into the strengths and weaknesses of your own travel program. By benchmarking your program against similar companies based on number of employees, air spend or industry you can gain a better understanding of where your company can improve.

As the additional data brings more clarity, you will have a clearer picture of how your employees’ business travel influences sales in the various markets. You can then boost profits by putting your resources into the most lucrative areas of your business.

4. Control spend, manage and track against budgets

Manage supplier targets and track against budgets through real-time analysis of your travel data. With spend data at your fingertips; you are in a stronger negotiating position with suppliers. You can also build a complete picture of where non-compliant spend is happening and take steps to reduce it.

Discover gold in your T&E data

VAT reclaim is just one of many ways you can find gold in your T&E data- check out the Concur App Center to see what else you can do with your SAP Concur data.

Taxback International offer a free VAT analysis to discover your VAT reclaim potential. Get started today to find big money and uncover hidden savings or check us out at Fusion 2020, Booth 751.