App Center

SimNomics - Expense

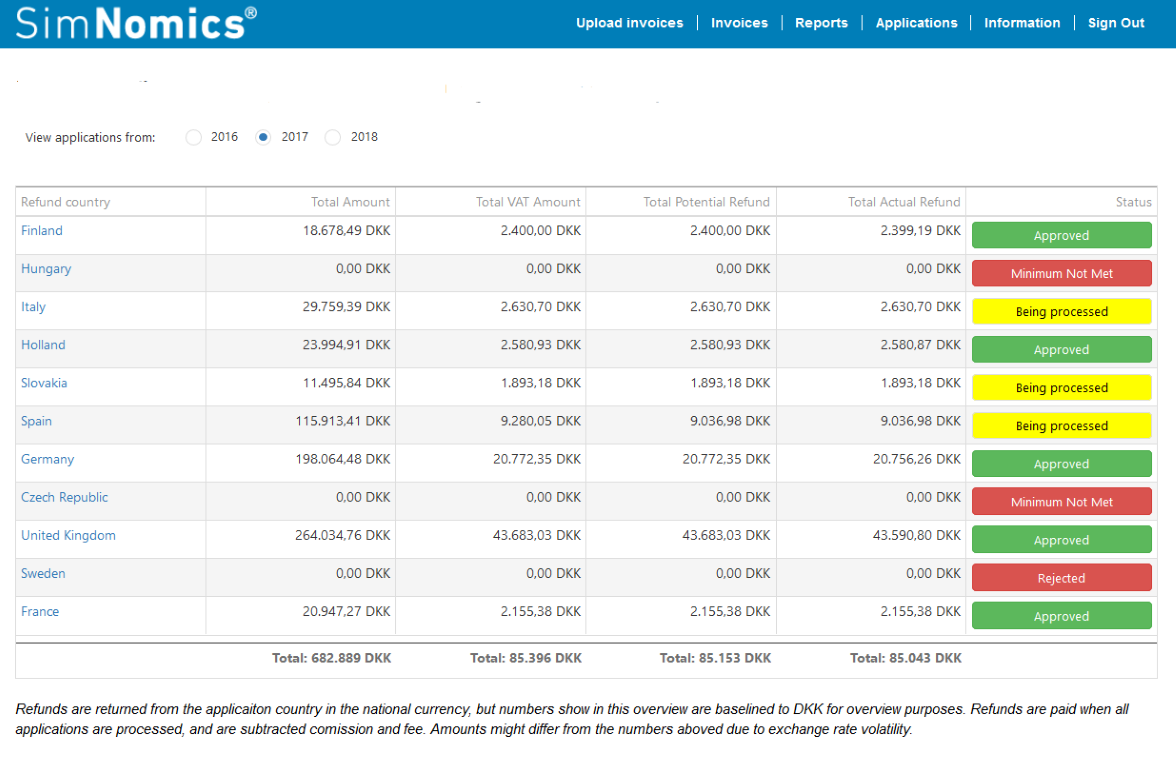

Digital and transparent foreign VAT refund

At SimNomics, our aim is to obtain the highest possible foreign VAT refund amount for our customers. We not only support our customers; we take over the whole application and communication process with national and foreign tax authorities.

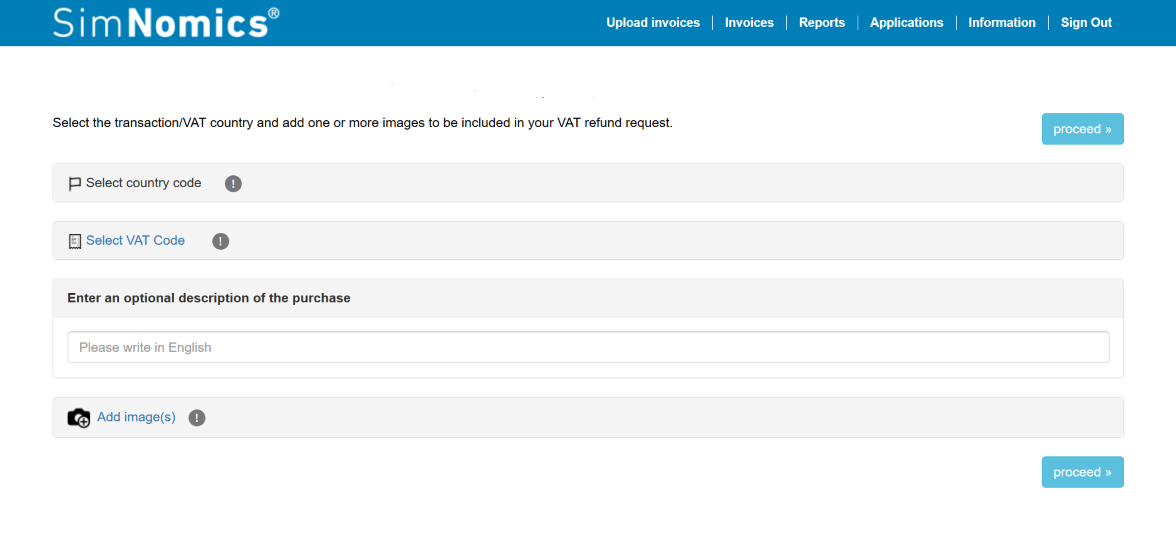

Through the integration with Concur Expense and Invoice, SimNomics pulls data from your SAP Concur solution and automatically processes the data for your foreign VAT reclaim – no more calculating, typing, or administrating. In addition, SimNomics’ service is on commission, based on the actual refunded amount of foreign VAT, following the principle “No cure, No pay”.

Reference Customers:

BORA Holding GmbH: “SimNomics pays high attention on quality, compliance and digitalisation. We are very satisfied to have SimNomics as our partner for foreign VAT refund; in particular we appreciate the professional, cooperative and personal collaboration.”

Sticks'n'Sushi A/S: “Our collaboration with SimNomics works impeccably and we will, at any time, recommend others to use their service. They really work at eye level, in terms of understanding our business needs.”

Sweco Danmark A/S: “We appreciate the collaboration with SimNomics on VAT reimbursement, which means that we have made use of the opportunity to collect the VAT refund that we are entitled to.”

To get started, submit a “Request Information” form to SimNomics for more information about the integration.

Works with these SAP Concur solutions:

Expense - Standard

Expense - Professional